About Us

Providing exceptional returns since 2006

We specialise in investment opportunities and loan types not offered by traditional banks.

We are a non-bank lender with flexible solutions for borrowers and investors

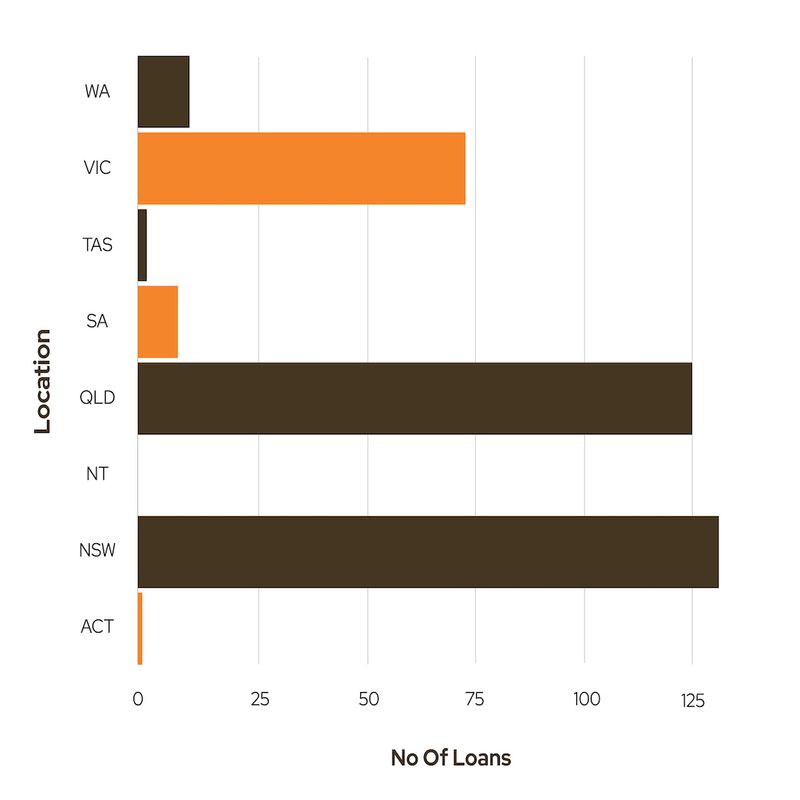

We offer a variety of flexible lending solutions, which may not be available through traditional lending channels, to borrowing clients with Australian real estate as security for the loan.

As a non-bank lender, Credit Connect Group (CCG) introduces these loans as mortgage investment opportunities to our network of private investors.

Acceptable security types for our loans include commercial property, residential property, construction and development projects as well as certain other specialised real estate assets

Meet the CCG team

Our team at CCG have accumulated over 100 years of experience in a range of sectors throughout the property and finance industries. Our knowledge and skills that we offer in private lending and mortgage investments is what differentiates us from other Non-Bank Lenders.

Peter Benson

CEO

Cam Ly

Non-Executive Director

Christopher Bristow

Non-Executive Director

We specialise in fast, efficient and flexible service

Credit Connect Capital Ltd is an unlisted public company. We hold an Australian Financial Services Licence no. 230173 (issued by the Australian Securities and Investments Commission). This enables us to operate both registered and unregistered managed investment schemes. We currently offer investment into the Credit Connect Select Fund for which we act as Trustee.

Credit Connect Finance Pty Ltd holds Australian Credit Licence no. 396190 (issued by the Australian Securities and Investments Commission) allowing us to provide loans to consumers which fall under the National Credit Code.

Why choose CCG?

As an experienced non-bank lender, we are able to offer access to funding not available via traditional channels

Why borrow with us?

There are many reasons why borrowers choose CCG:

- Experienced non-bank lender

- Access funding not available via banks, credit unions or building societies.

- Fast approval and settlement times

- Funding specifically for your project

- We have no hidden fees

- Fixed rate, interest only

- Flexibility - No two loans are the same.

Why invest with us?

- Receive monthly income

- Your investment is secured Australian property

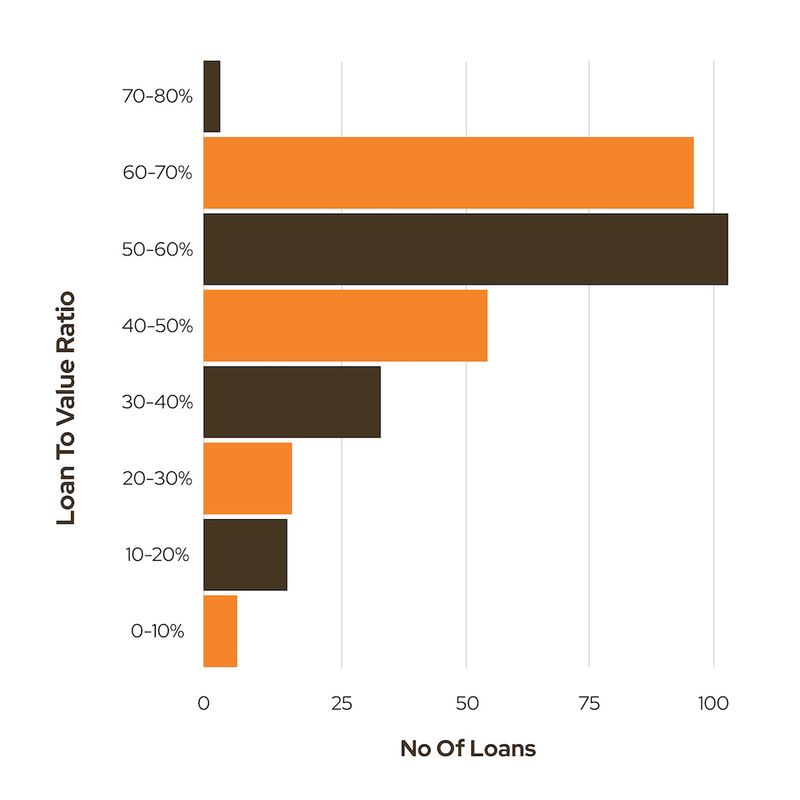

- Conservative Lending Ratios

- Transparency - Know exactly where your funds are

- Freedom to undertake your own due diligence

- You are in control of your risk appetite

Our clients include...

INVESTORS:

- Sophisticated Investors

- Wholesale Investors

- High-net-worth Individuals

- Religious Groups and Charities

- Investment Banks

- Family Offices

- Foreign Investors

- Hedge Funds

- Overseas State Owned Enterprises

BORROWERS:

- Companies

- Individuals

- Self-employed Business Owners

- Small and Medium-Sized Enterprises

- Self-Managed Super Funds

- Property Investors and Developers

REFERRERS:

- Brokers

- Real Estate Agents

- Accountants

- Law Firms

- Financial Planners

Service providers

History of success since 2006

Want to learn more?

Find out how CCG can help you to build your wealth and generate stable, ongoing monthly income. Speak to our team to find out more.

Call: 1300 795 507 or Email: [email protected]